Services

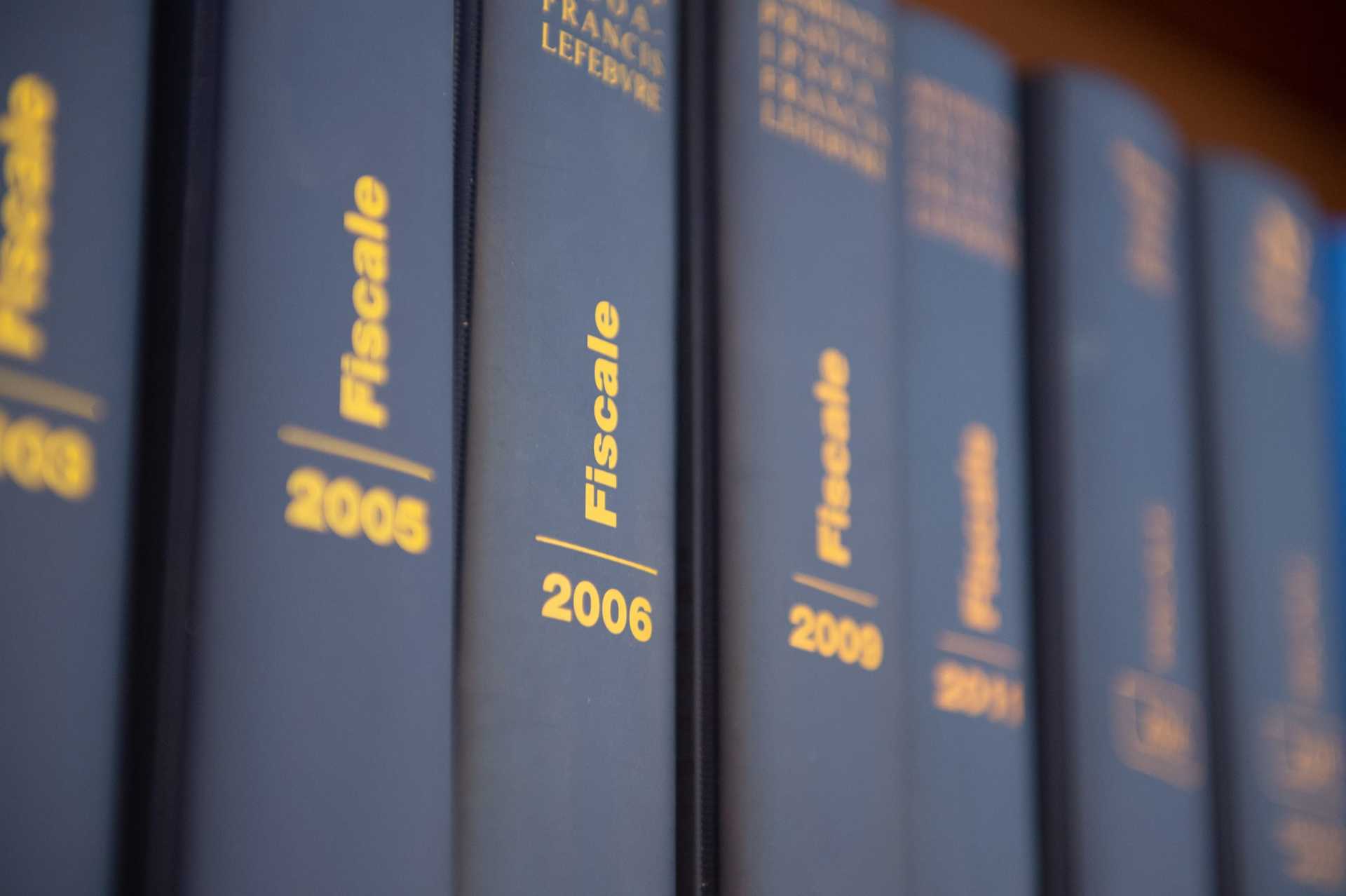

TAX SERVICES

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

- Ordinary tax assistance

- Extraordinary tax assistance related to non-recurring corporate transactions (reorganisations, mergers, transfers, demergers, sales, assets and equity deals, equity investments, etc.)

- Assistance in the study phases, preparation of tax / financial modeling and contradictory with Agenzia delle Entrate (the Italian Tax Authority) for the purpose of facilitating the Patent Box

- Tax planning at national and international level

- Planning and optimization of taxation of people

- Corporate and participations evaluations

- Assistance to domestic and foreign investments

- Corporate assistance and consultancy

- Administrative, accounting and human resource management consultancy

- Assistance in tax audits

- Definition of disputes with the Financial Administration

- Defense in tax litigation (appeals, complaint, representation before the Authorities)

- Formulation of enquiries, requests, etc...

- Conducting due diligence activities

- Ordinary and extraordinary insolvency procedures: restructuring, divestitures, liquidations

LEGAL SERVICES

- National and international contracts

- Corporate and commercial law

- Mergers & Acquisitions

- Restructuring and corporate reorganization, etc. ...

- Labor law

- Industrial law (trademarks, patents, unfair competition)

- Administrative law

- Bankruptcy law

- Labor law

- Banking and finance law

- Real estate law

- Due diligence activities

- Legal assistance

- Ordinary and extraordinary insolvency procedures: restructuring, divestitures, liquidations

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

- National and international contracts - Corporate and commercial law - Merger & Aquisition operations - Restructuring and corporate reorganization, etc. ... - Labor law - Industrial law (trademarks, patents, unfair competition) - Administrative law - Bankruptcy law - Labor law - Banking and finance law - Real estate law - Conducting due diligence activities - Legal assistance - Ordinary and extraordinary insolvency procedures: restructuring, divestitures, liquidations

TAX LITIGATION

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

Slide title

Scrivi qui la tua didascaliaButton

- Instances of installment payment

- Assistance for tax assessments

- Formulation of tax rulings

- Applications for tax refunds

- Administration of tax assessments, goodwill and assessment notices

- Contradictory procedures with Financial Bodies

- Assessments with acceptance

- Preparation and discussion of appeals with the Provincial Tax Commission

- Preparation and discussion of appeals in the Regional Tax Commission

- Court settlements

- Interim injunctions

Brescia 25122, via Leonardo da Vinci 20 t +39 030 3702830

Milano 20122, Via Gaetano Donizetti 45 t +39 02 97101448

Brescia 25122, via Leonardo da Vinci 20

Milano 20122, Via Gaetano Donizetti, 45

© 2024

All Rights Reserved | Studio Sebastiani

Privacy |

Cookie Policy